Coding bootcamps evolved from fringe vocational programs into a mainstream pathway into software roles over the past decade.

By 2025, the sector reflects three simultaneous realities:

- measurable success for some graduates

- wide variance in outcomes across providers

- mounting structural pressure from regulation, financing models, labor market saturation, and rapid adoption of AI

This article synthesizes audited outcome data, market research, journalism, and regulatory signals to present a realistic, evidence based view of coding bootcamp statistics in 2025 and what students, employers, and policymakers should expect in 2026.

Definition: What Coding Bootcamp Statistics Actually Measure

Coding bootcamp statistics typically refer to quantitative indicators such as tuition cost, program length, graduation rates, placement rates, time to employment, and post-program salary outcomes.

The reliability of these coding bootcamp statistics varies widely. Audited data from third parties such as the Council on Integrity in Results Reporting provides stronger signals than self-reported marketing claims.

Methods and Data Sources

This analysis prioritizes independently verified or audited sources.

Primary inputs include:

- CIRR audited outcome reports

- Course Report market surveys and tuition analysis

- Investigative journalism from Reuters, Inside Higher Ed, and SSTI

- Financing and regulatory analysis from CareerKarma and CFPB enforcement actions

- Labor market context from LinkedIn and Stack Overflow surveys

Where direct public data is unavailable, conservative estimates are labeled explicitly.

Market Scale and Pricing in 2026

Key Verified Metrics

- Program length: 3 to 6 months full-time, or 6 to 12 months part-time

- Tuition range: approximately USD 3,500 to USD 30,000

- Average tuition: around USD 14,000

- Reported first-job salary medians: USD 60,000 to USD 75,000, with significant geographic variance

Why These Numbers Matter

Tuition and first-job salary determine economic viability. Across audited programs, payback periods vary sharply based on local wages and placement speed. Programs with strong employer pipelines consistently outperform peers.

Employment Outcomes and Placement Reality

What Audited Data Shows

Among CIRR-reporting bootcamps:

- Employment-in-field rates for job-seeking graduates typically range from 60 to 85 percent within six months

- Time to placement varies significantly even among top tier programs

The Transparency Gap

Non-CIRR schools often advertise higher placement rates without standardized definitions or audits. This makes cross-school comparison unreliable and increases student risk.

Key takeaway: Audited reporting materially reduces information asymmetry.

Financing Models and Student Risk

Common Payment Structures

- Upfront tuition

- Private loans

- Installment plans

- Employer sponsorship

- Income Share Agreements

Structural Stress in ISAs

CareerKarma data shows a sharp decline in ISA availability, with only a small percentage of schools offering them by 2024. Regulatory scrutiny intensified after CFPB enforcement actions challenged ISA disclosures and marketing practices.

Implication: Financing terms are now a major source of downside risk when outcomes underperform.

ROI and Payback Analysis

Conservative ROI Model

Assumptions:

- Tuition: USD 14,000

- Post-bootcamp salary: USD 65,000

- Placement within 3 to 6 months

Under these conditions, ROI can be strong for career switchers. However, if placement extends beyond six months or roles are underleveled, payback may take years.

Distribution Matters

Average outcomes hide variance:

- Top performers may double or triple income

- A long tail struggles to secure relevant roles

Risk-averse students should model worst-case scenarios.

Who Bootcamps Serve Today

Demographic Signals

- Many attendees already hold college degrees

- Career changers remain a core audience

- Outcomes for underrepresented groups improve where employer partnerships exist

Programs lacking local hiring networks show weaker equity outcomes.

Market Consolidation and Provider Stability

Observed Trends

- Closures and pauses among smaller providers

- Consolidation among employer-aligned programs

- Investor pullback in weaker segments

Drivers include market saturation, junior hiring slowdowns, regulatory pressure, and financing failures.

The AI Shock to Bootcamp Outcomes

Labor Market Impact

Investigative reporting links AI adoption to reduced demand for routine junior coding tasks in some regions. This compresses entry-level hiring and raises the bar for employability.

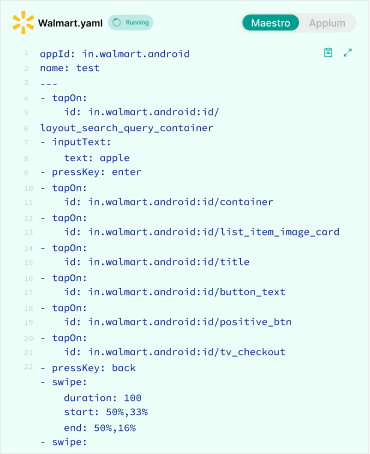

Program Responses

Some bootcamps integrate AI tooling, prompt engineering, and system-level thinking. Outcome data for these pivots remains early and lightly audited.

Net effect: AI increases both risk and opportunity depending on curriculum relevance.

Manual Credential vs Market Reality

Credential Inflation

Employers increasingly expect:

- Portfolio depth

- Open-source contributions

- Real project experience

Certificates alone are insufficient.

Underemployment Risk

Some graduates accept roles labeled developer but perform lower-skill tasks. Without granular reporting, headline placement rates obscure this reality.

Comparative View: High-Quality vs High-Risk Bootcamps

| Dimension | High-Quality Programs | High-Risk Programs |

| Outcome reporting | CIRR audited | Self-reported |

| Employer ties | Strong local partnerships | Minimal |

| Financing clarity | Transparent | Opaque |

| Curriculum | Updated, AI aware | Static |

| Placement support | Structured | Limited |

Practical Recommendations

For Students

- Prefer CIRR-verified outcomes

- Model conservative placement timelines

- Scrutinize financing terms carefully

For Employers

- Treat bootcamp grads as early-career hires requiring mentorship

- Structured integration improves ROI

For Policymakers

- Standardize outcome disclosures

- Enforce transparent financing practices

Projections for 2026

Evidence-based expectations:

- Continued consolidation

- ISA financing remains niche

- Curriculum shifts toward AI-augmented workflows

- Outcome transparency becomes a competitive differentiator

Conclusion

Coding bootcamp statistics in 2025 reveal a fragmented sector. High-quality, transparent programs deliver real value, while opaque providers expose students to material risk.

AI and shifting hiring practices raise the bar for relevance but also create new pathways for well-designed programs.

The bootcamp model is not collapsing, but it is maturing. Transparency, realistic expectations, and continuous curriculum evolution will define success in 2026.

Suggested Next Step

Prospective students should create a short evaluation checklist comparing audited outcomes, financing terms, and employer partnerships before enrolling in any bootcamp.